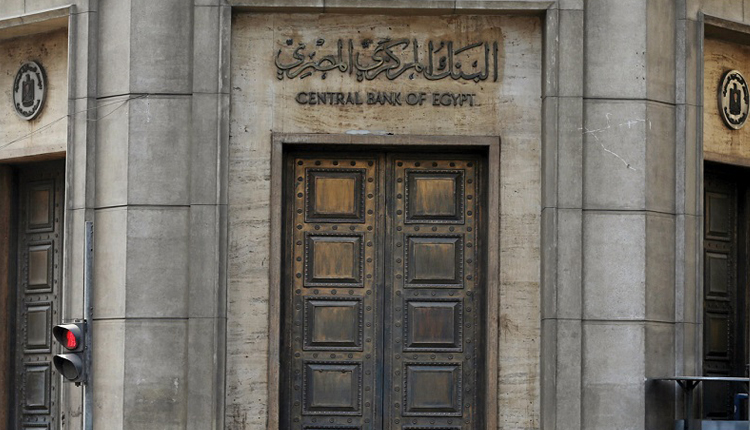

A new bill on Egypt’s banking sector is expected to be referred to the House of Representatives before the end of May after being reviewed and approved by the government, a well-placed source with the Central Bank of Egypt (CBE) said.

The bill comprises 240 articles, the source told MENA on Saturday.

The cabinet’s economic committee reviewed last week the final version of the bill in the presence of CBE governor alongside the ministers of investment, immigration, manpower, planning, administrative reform, tourism, finance, trade and the public business sector.

CBE Governor Tarek Amer has said earlier that drafting a new banking law falls within the framework of legislative reforms introduced by the state to cope with fast-paced global financial developments.

The proposed law is meant to support the basis of the legal framework on which the central bank governance should rest, i.e independence, accountability and transparency, Amer said, noting that it regulates cooperation between the central bank, government and authorities tasked with monitoring the financial sector.

The banking draft law ensures the adoption of best global practices and laws imposed by respective supervision authorities across the world, as well as making a leap in Egypt’s banking activities and subsequently realizing financial inclusion, the CBE source said.

The main objectives of the law are topped by protecting the banking system during times of crisis, keeping pace with global developments, along with upgrading governance of the CBE and other banks operating in Egypt, the source noted.

Redressing the cash-strapped banks alongside regulating supervision over payment services and financial technologies are among the main targets of the draft law, the source stated.

While attaching special importance to major global technological developments at the economic level, the articles of the draft law outlined legal frameworks for regulating the trade of digital currencies in the country.

Also, it set rules for fair competition, monopoly prevention and protection of the rights of customers in the banking sector.

The source went on to say that the draft law is based on recommendation by world bankers and experts, as well as proposals submitted to the CBE by other banks and bodies concerned in this regard.

Source: MENA