South African Gold Fields increased its forecast of the amount of gold to be produced in 2024 to between 2.33 million and 2.4 million ounces on Thursday. The company stated that it anticipates a swift increase in production at its new Salares Norte mine in Chile, which is expected to begin operations in April.

After multiple setbacks, the Johannesburg-based miner is pushing hard to get Salares Norte up and running. Last year, the company’s output fell as a result of lower production at its operations in South Africa and Ghana.

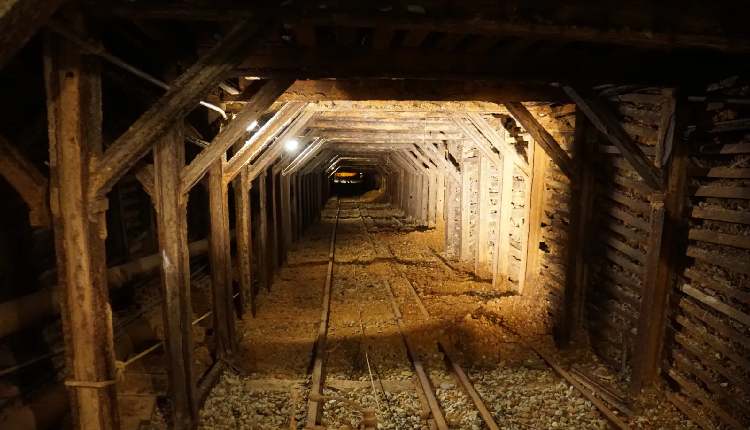

The $1 billion mine in Chile began construction in 2020, with production initially scheduled to begin in early 2023. However, because of delays brought on by COVID-19 and inclement weather, the mine has missed a number of its goals.

Salares Norte, a vital component of Gold Fields’ long-term plan to increase production to approximately 2.8 million ounces per year, is anticipated to yield 250,000 ounces of gold this year, with plans to ramp up to 580,000 ounces by 2025.

Mike Fraser, the CEO of Gold Fields, told Reuters that there was “a high degree of confidence” that the mine in Chile would quickly increase output after he assumed the position in January.

“We’re well positioned because we’ve already got about 520,000 ounces of gold sitting on stockpile. The mining operations have worked really well, we’re just now closing out the pre-commissioning and commissioning of the processing plant,” Fraser stated.

Due to a decrease in output and increased expenses, Gold Fields reported headline earnings of $837 million for the year ended December 2023, a 21 per cent decrease from $1.06 billion the year before.

Attributable gold production was down 4 per cent from the prior year to 2.304 million ounces, while industry-measured all-in-sustaining costs increased 17 per cent to $1,295 per ounce.

Additionally, Gold Fields’ 2023 earnings were lower than their 2022 earnings due to a $202 million break fee it received following its unsuccessful attempt to purchase Canada’s Yamana Gold.

A final dividend of 4.20 rand ($0.2222) per share was declared by the company, bringing the total dividend for the year to 7.45 rand.