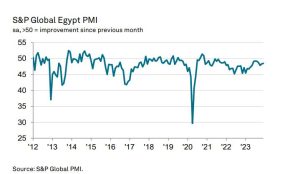

Egypt’s non-oil private sector conditions worsened at the end of 2023, according to the latest S&P Global Purchasing Managers’ Index (PMI) data, which is an economic indicator derived from surveys intended to give a quick overview of business conditions.

The latest data indicates that activity and new orders fell more sharply as demand slowed. Moreover, survey evidence the decline in the value of the pound and continuous supply constraints were significant factors in the crisis, which caused businesses to experience a sharp increase in input costs as well as a decrease in consumer spending.

Companies were encouraged to limit price increases by weaker demand trends, which led to a relatively small increase in selling expences.

The headline seasonally-adjusted S&P Global Egypt PMI posted 48.5 in December, marginally higher than the reading of 48.4 in November. The index indicated a slight decline in the non-oil sector’s health, but it was less severe than the average for the previous year (47.9).

However, the most recent data also show a worsening decline in new order volumes in December, which respondents frequently associated with exchange rate issues and high inflation. Moreover, the wholesale and retail sector’s companies reported a particularly steep decline in new orders, which fell at the fastest rate since May.

As a result, non-oil companies further reduced their output levels in December, and the rate of contraction accelerated slightly compared to November. Lower output requirements translated into another drop in input purchases, although the reduction was one of the slowest seen in the past two years.

S&P Global Egypt PMI

sa, >50 = improvement since previous month

Data were collected 06-14 December 2023

Employment levels rise; output expectations improve

The primary factor driving the headline PMI’s increase at the end of 2023 was employment, as survey data showed that staffing had increased for the first time since September.

Companies hired additional staff in an attempt to increase capacity, partially in response to increases in outstanding business in each of the previous five months. As a result, increased employment enabled businesses to maintain relatively stable backlogs of work in December.

Improved business expectations coincided with renewed labour market expansion, as a larger percentage of companies anticipated increased activity and the relaxation of financial difficulties. The level of optimism was significantly higher than the second-best in 2023 and the series-record low in November.

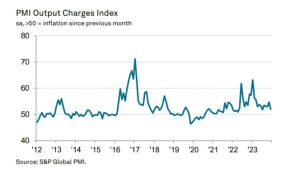

Selling price inflation softens

The most recent survey data indicated that non-oil economy input costs increased significantly again in December, maintaining pressure on balance sheets due to supply-side shortages as well as weakening currency.

Increasing costs were mostly caused by higher purchase prices, even though the rate of inflation decreased slightly from November.

Wages also provided some relief, rising at the slowest rate since July.

In December, output charges were once more removed; however, survey data indicated that companies attempted to restrict increases to maintain sales to their clients. Overall selling charges increased very slightly, and the rate of inflation decreased significantly from its eight-month peak in November.

PMI Output Charges Index

sa, >50 = inflation since previous month