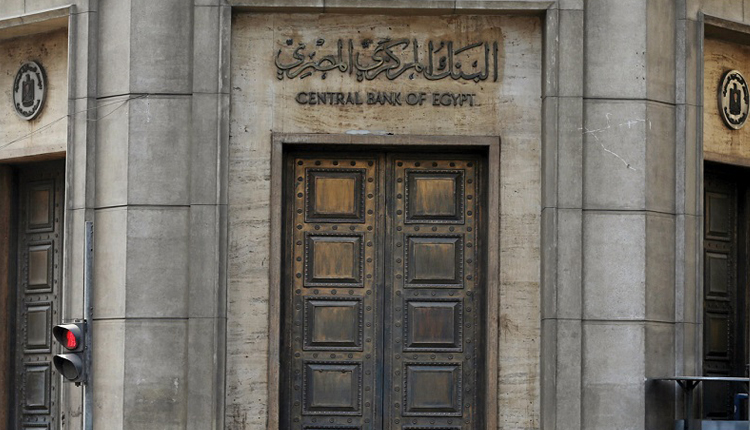

Egypt’s foreign reserves are still within “safe” levels despite the recent decline for two months in a row, said deputy governor of the country’s central bank on Sunday.

The reserves fell to around $37.04 billion at the end of April compared to about $40.11 billion at the end of March, a decline of roughly $3.1 billion.

Ramy Aboul-Naga said the reserves cover commodity imports for roughly seven months.

The coronavirus pandemic’s impact on the global market are carrying on for the second month in a row, albeit at a lower rate to the previous month which saw the peak of exits of foreign investment portfolios from emerging markets.

The Egyptian central bank is handling the coronavirus crisis in a proactive manner, therefore moving early through a large financing package and exceptional measures to support and strength the national economy, Aboul-Naga added.

Egypt used its foreign reserves during April to repay a Eurobond worth $1 billion as well as to cover the imports of strategic goods worth nearly $3.1 billion.

This included the exit of some investors through the central bank’s mechanism for transferring money from foreign investors.

Aboul-Naga ruled out any substantial impact resulting from the decline in foreign reserves on the balance of payments and the banking sector.

The domestic market exceeded the peak of foreign investment exit from the government’s debt instruments market – treasury bills and bonds, the central bank official asserted.

33