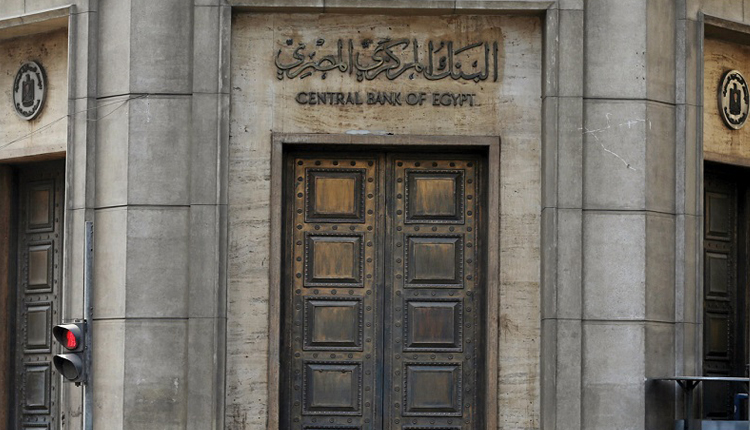

Egypt’s current account deficit for the 2017-18 financial year that ended in June narrowed by 58.6 percent to $6 billion, the central bank announced on Monday.

The central bank attributed the decline in the deficit to the impact of currency liberalisation. Egypt let its pound float in late 2016 as part of an IMF-backed economic reform programme.

Since then the pound has more than halved in value, helping to cut the trade deficit and attract foreign investment that had dried up after an uprising in 2011.

Net foreign direct investment (FDI) for the 2017-18 financial year was $7.7 billion, of which $4.5 billion was in the oil sector, the bank said. The net FDI figure was down from $7.9 billion in 2016-17.

The trade deficit stood at $37.3 billion, compared with $35.4 billion for the 2016-17 financial year.

Portfolio investment slowed to a net inflow of $12.1 billion, down from $16 billion, mostly due to lower foreign investment in treasury bills.

Remittances from Egyptians working abroad rose sharply, to $26.4 billion from $21.8 billion year earlier.

Egypt has borrowed heavily from abroad since 2016, and is looking to tap the international financial market at a time when emerging market turbulence has pushed up rates.

Egypt’s current account deficit for the fourth quarter of 2017-18 was $642.2 million, 73 percent less than for the same period the previous year, a Reuters calculation showed.

The overall balance of payments registered a surplus of $12.8 billion compared with a surplus of $13.7 billion a year earlier, the statement said.

Source: Reuters