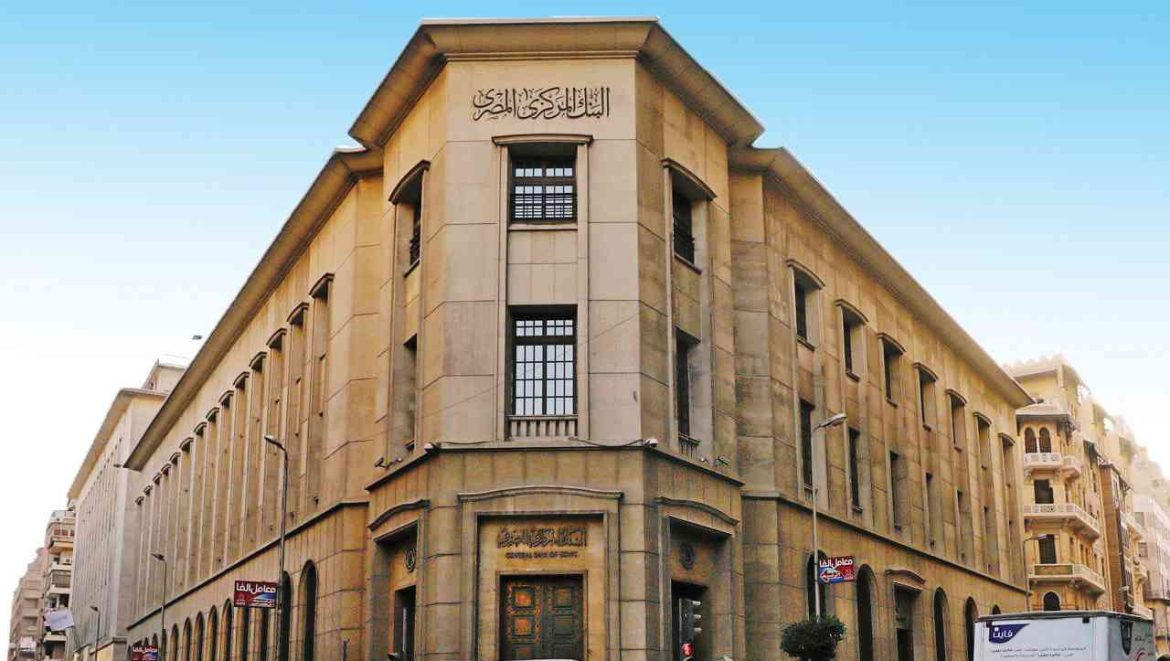

Egypt’s central bank has launched on Tuesday a new initiative to guarantee import operations through covering risks associated with issuing letters of credit (L/Cs) from banks.

In a letter to banks, the Central Bank of Egypt (CBE) said the initiative targets clients who have history of importing goods through documentary collection from the same bank.

CBE clarified that the credit risk guarantee company will guarantee the bank’s portfolio under this initiative by 100 percent for the part which is not covered by these credits.

Banks will be exempted from the guarantee commission for six months starting from the date of activating the initiative provided that the company provides the banks with the determinants and framework of working under this initiative.

The new initiative runs in line with the CBE’s new regulations issued on February 13 to regulate imports through L/Cs instructing banks to only accept letters of credit from importers.

A group of trade and business associations had complained in a letter to the Egyptian prime minister on Monday that the new rules could exacerbate supply chain problems, damage competitiveness, and delay import shipments. The CBE also decided to exclude medicines, serums, chemicals, and food commodities, including tea, meat, poultry, fish, wheat, oil, powdered milk, baby milk, beans, lentils, butter, and corn, from the new import regulations.