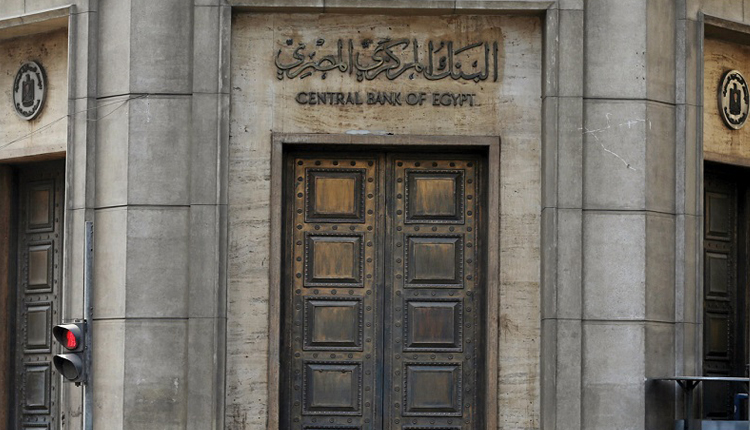

The new regulations allow banks to sign contracts with international financial institutions, banks, and exchange bureaus to carry out export transactions on the condition they set an insurance limit that is annually renewed.

Banks must have the CBE’s approval to carry out the transactions through an Egypt-based company.

Banks wishing to export and import foreign currencies have to apply for a 12-month licence every January, and they have six months from the date the regulations were issued to work out their status.

The new CBE regulations also stipulate that qualifying institutions must be subjected to the supervision of a regulatory body. They are to be authorised to import foreign currency five years after having been established, provided they don’t receive fines or punitive measures from their domestic regulators. Qualifying institutions must have internal procedures to combat money laundering and terrorist financing as well.

The value of a single export transaction, according to the new CBE regulations, cannot exceed $100 million, or their equivalent in other currencies. Banks should hire an international company specialising in determining the rate of the foreign currency not listed on the CBE’s rate chart if any transaction is between $2 million and $10 million and is, of course, approved by the CBE.

Before the transaction takes place, banks must demonstrate that they are sufficiently capitalised to continue normal operations while engaging in foreign exchange (forex) transactions.

Meanwhile, the CBE must approve the transaction at least one day beforehand.

Banks must, in addition, provide the CBE with proof of the value and rate of their forex exports within a maximum of 10 days after the transaction, but the CBE may withdraw a bank’s licence at any given time without disclosing reasons. CBE approval is also required for foreign currency imports.

Source: Ahram Online