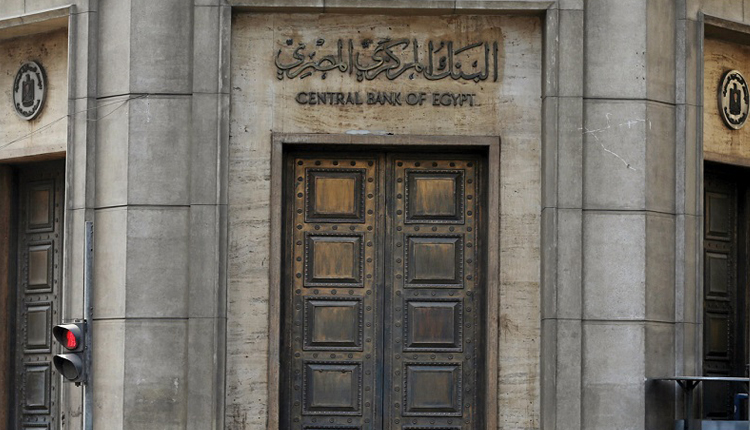

Central Bank of Egypt (CBE) offered on Sunday treasury bills worth 20.5 billion Egyptian pounds ($1.3 billion) over two terms to provide finances to fill the state’s budget deficit.

The first offer was 182-day term T-bills worth 9.5 billion pounds, while the second offer was 375-day term T-bills worth 11 billion pounds, according to the bank.

The maturity date of the first offer will be on 23 February 2021, while the maturity date for the second offer will be on 17 August 2021.

Offering T-bills in auctions is an instrument Egypt’s government counts on to deal with the state’s budget deficit, which was widened under the pressure of the coronavirus to 6.5 percent of GDP in the financial year 2019/2020, up from 6.2 percent in the financial year 2018/2019.

Egypt’s financial year 2019/2020 budget deficit recorded 389.1 billion pounds, around $24 billion at the end of May, the Finance Ministry announced.