For any central bank balking at freeing up its currency for the fear of inflicting pain on the economy, the turnaround being enjoyed by companies in Egypt may provide some comfort.

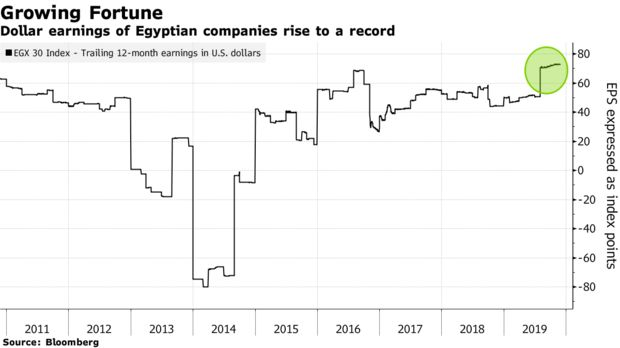

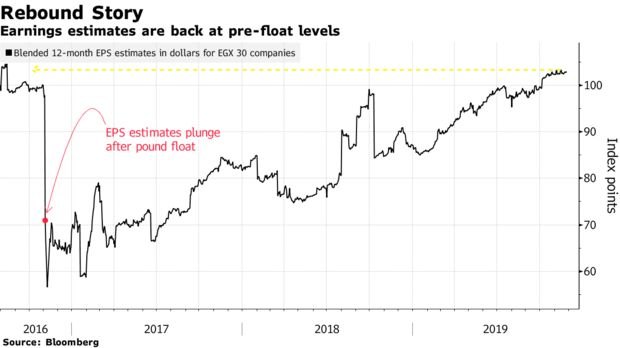

Three years after Egypt let markets set the pound’s value, its companies are witnessing a rebound in profits, according to a report by Bloomberg on Thursday. While earnings have surged to a record in dollar terms, estimates have returned to levels last seen before the float, which took place in November 2016.

It’s a transformation for Egypt that in November 2016 was forced to liberalise an overvalued currency and cut subsidies to obtain a $12 billion bailout from the International Monetary Fund. The measures, aimed at easing a dollar squeeze, initially caused inflation to accelerate to 33 percent and sent earnings plunging.

“Today, it’s inflation that’s near a record low. Foreign currency reserves are booming and the stock market is 62 percent bigger than its post-float low. Projections for economic growth of 5.6 percent this year and the pound’s best annual performance since at least 1999 are firing up earnings.”

Andrew Schultz, the head of Africa strategy and sales at Investec Bank Ltd. in Johannesburg, told Bloomberg: “Egypt is a very good example of what happens when a country ends currency management and lets it float in the market,”

“It’s a success story that a number of countries in the region could learn from — especially Nigeria and Kenya.” Schultz added.

Higher earnings estimates reflect the adjustment the economy has gone through and investors’ improved perception of the nation of 100 million people, Schultz said. Moderating inflation has contributed to investor returns, he said.

“Rising profit expectations are making Egyptian stocks cheaper too. The EGX 30 Index trades at 8.3 times projected 12-month earnings, one of the lowest valuations in emerging markets.” Bloomberg report read.

Source: Bloomberg