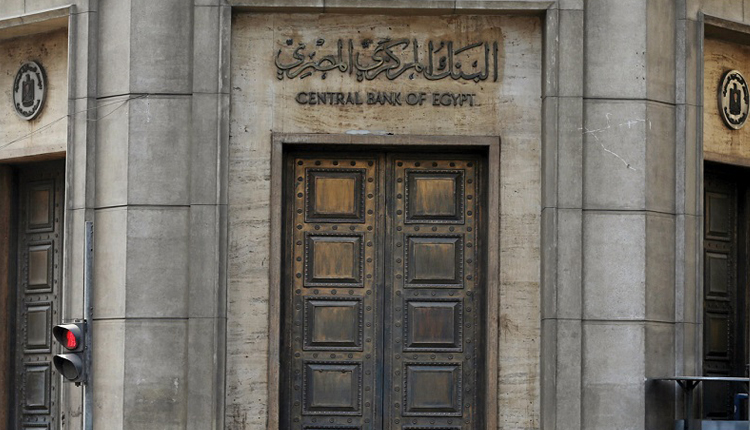

Egypt will likely extend this year’s pause in monetary easing on Thursday and hold interest rates as the hike in global prices will trickle through to inflation, a Bloomberg survey predicted.

Authorities in Egypt are seeking to maintain foreign appetite for local debt.

Recent weeks have seen costs in Egypt raised for fuel, electricity, and tobacco products, steps that partly reflect the worldwide hike in commodities and may spur quickening in inflation.

All 11 economists surveyed by Bloomberg expect the Egyptian central bank’s Monetary Policy Committee will hold its benchmark deposit rate at 8.25 percent for a sixth consecutive meeting, after cutting a combined 400 basis points in 2020.

“The rise in global inflation is starting to hit home,” Mohamed Abu Basha, head of macroeconomic research at EFG Hermes, told Bloomberg.

“Producers are also gradually reflecting their rising input costs on products, although that’s happening at a slow pace. This will leave the central bank keeping a close eye on inflation.” Abu Basha added.

On Tuesday, Egyptian President Abdel Fattah al-Sisi called for an increase in prices of subsidised bread, a move the government is studying although there have been no official figures yet on what the new cost could be.

Another key consideration will be keeping a wide differential between Egypt’s inflation and policy rates, currently the broadest of over 50 economies tracked by Bloomberg.

That ranking has helped increase the size of foreign holdings in the Egyptian debt to more than $28 billion, important funding while the tourism industry awaits full recovery from the pandemic shock.

Local-currency bonds have returned around 7 percent this year, the biggest gainer in emerging markets after Argentina and South Africa, Bloomberg Barclays indexes showed.

Any surge in Egypt’s inflation is expected to be both limited and short-lived, remaining within the central bank’s target range of 5-9 percent. Consumer prices in urban parts of Egypt accelerated to an annual 4.9 percent in June, up from 4.8 percent in May.

HSBC Holdings Plc said in a note that after an expected increase in July, price growth will probably remain well below the mid-point of the target into next year, “contained by muted demand-side pressures and continued currency strength,”

While other emerging-market peers such as Russia, Brazil, and Ukraine are tightening monetary policy, “we see no need for Egypt to follow suit,” Simon Williams, HSBC’s chief economist for Central and Eastern Europe, the Middle East and Africa, said.

“A surprise cut remains a more pronounced risk than a hike” for both Thursday’s meeting and the rest of the year, Williams added.

45