A delegation from the Egyptian central bank (CBE) on Wednesday arrived in Stockholm, aiming to get insights into regulatory, technological and societal aspects of Sweden’s work towards a cashless society.

The delegation is headed by the central bank deputy governor Lobna Helal and comprises senior officials from the CBE and the Egyptian banking, credit, and fintech sectors.

During the two-day visit, the Egyptian delegation will meet with counterparts at the Central Bank of Sweden, the Financial Supervisory Authority (Finansinspektionen), banks, fintech hubs, and other key stakeholders within government, academia and the private sector.

Egypt is an important trading partner for Sweden, with being ranked among the 26 priority countries in the Swedish government’s trade strategy. The North African country braces for implementing its ambitious agenda for economic reform, including financial inclusion and turning into a cashless society.

Sweden is one of the world’s most financially inclusive societies, with an account penetration of 100 percent and internet or mobile access at over 98 percent. Sweden’s work towards a cashless society has drawn international attention, particularly since it embodies the Swedish triple helix model. Government, academia, and private enterprises have joined forces in creating technical and regulatory frameworks that allow citizens and enterprises to have easy and cheap access to integrated e-payment solutions, e-government services and e-banking all through a government backed electronic-id system that is jointly managed by the majority of Swedish banks.

“Fintech is a key sector for Swedish-Egyptian cooperation. By working together, Egypt will be able to make both a quantitative and a qualitative leap when it comes to digital economy and financial inclusion. We are proud to be your partner,” said the Ambassador of Sweden to Egypt, Jan Thesleff, who is accompanying the Egyptian delegation to Sweden.

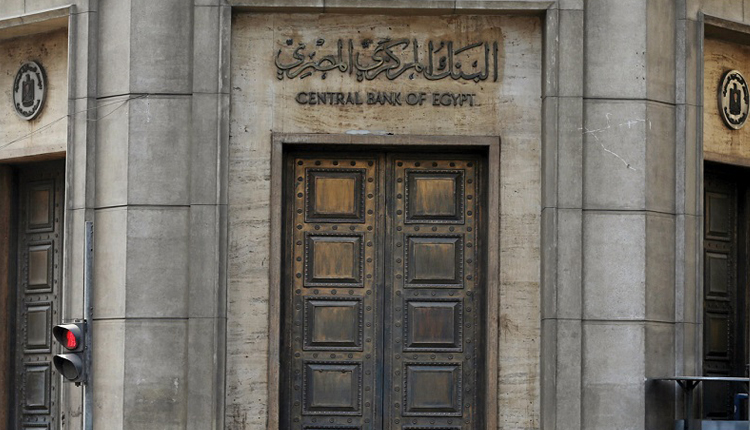

Egypt’s central bank deputy governor Lobna Helal with Swedish officials