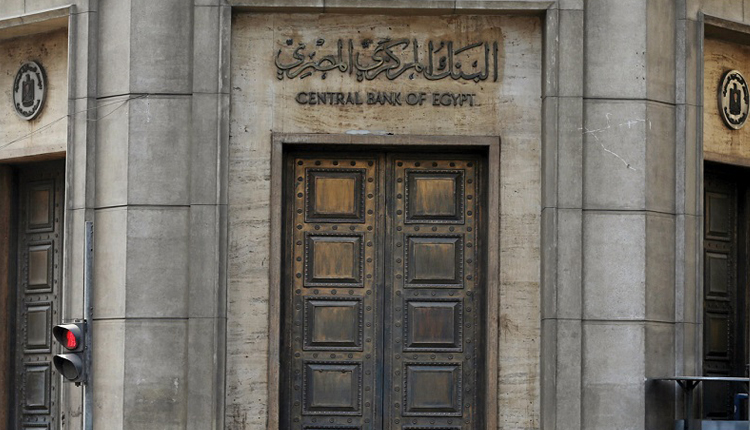

Egypt’s central bank has launched on Thursday a risk-free interest rate benchmark, in cooperation with the European Bank for Reconstruction and Development (EBRD).

The new benchmark, the Cairo Overnight Interbank Average (CONIA), is part of the central bank’s significant steps in furthering the development of its money, derivatives, and capital markets. The move is in line with the international movement towards developing risk free rates as the -IBOR benchmarks are being phased out.

Under the name of Cairo Overnight Interbank Average (CONIA), the benchmark was developed by the Egyptian Money Market Contact Group (MMCG), which brings together the central bank, commercial banks, and the EBRD.

CONIA reflects rates on interbank transactions that are virtually risk free because of their very short tenors.

The introduction of benchmark is “an important milestone to support money market reform that is consistent with CBE senior management’s vision”, said Rami Abulnaga, Sub-Governor for Markets and External relations at the Central Bank of Egypt.

EBRD treasurer Axel van Nederveen said it made an important contribution towards the development of the Egyptian financial markets, adding that similar risk-free rates had already been developed for major currencies in other monetary jurisdictions.

“The transparency and robustness of the benchmark will support the development of a broader set of products for financial sector participants and improve the resilience of the capital markets and the overall economy.” EBRD said in a statement.

The Egyptian Money Market Contact Group was set-up in 2018 to promote safe and efficient local currency money markets.

Following the introduction of CONIA, the group plans to focus on developing instruments that will use the new benchmark. It will also work to enhance domestic money markets and to ensure that CONIA continues to provide an accurate reflection of underlying market conditions, the statement added.