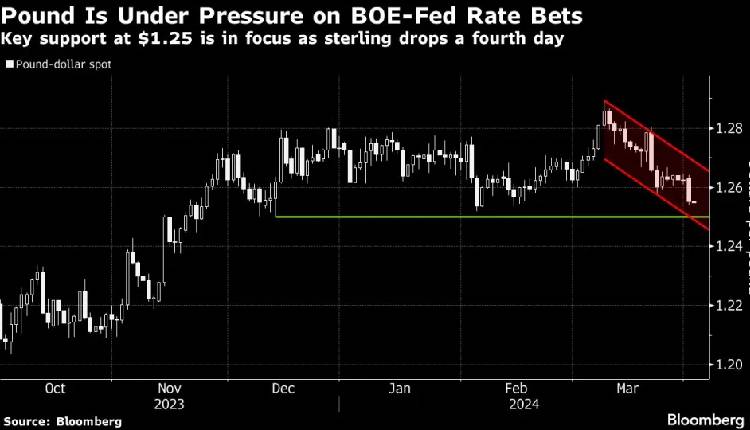

The pound sterling fell towards $1.25, a level not seen since December, as traders bet on the Bank of England (BOE) making more interest rate cuts this year than the Federal Reserve, Bloomberg reported.

Sterling declined by 0.1 per cent to $1.2546 on Tuesday, extending Monday’s losses following data that showed an unexpected expansion in US factory activity in March, the first since September 2022.

This marks a significant turnaround for the currency, which traded as high as $1.2894 in early March before facing pressure when two of the BOE’s most hawkish members withdrew their calls for hikes at the most recent meeting.

Current money market predictions price in 64 basis points of rate cuts in the US this year, compared to 72 basis points in the UK.

The probability of a quarter-point reduction by the BOE in June stands at around 63 per cent, while the likelihood of a similar move by the Fed briefly dipped below 50 per cent on Monday.

In the options market, traders seeking to hedge against a weaker pound are faced with paying a substantial premium across tenors. Market sentiment towards the currency’s performance this week is nearing its most bearish level since late October.