Saudi Arabia has raised $12 billion from foreign debt, marking its largest borrowing since 2017, during a record-breaking start to the year for emerging-market countries.

The kingdom’s recent bond sale has contributed to the nearly $25 billion in bonds that developing countries have sold since the beginning of the year, and the largest of these sales was a $7.5 billion offering from Mexico.

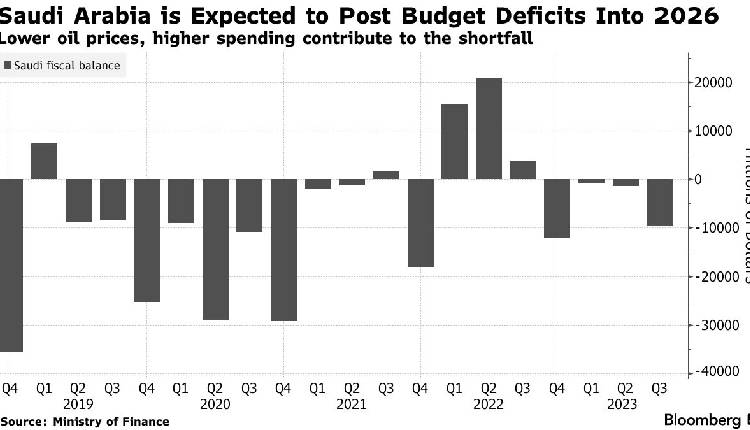

The Saudi deal represents over half of the government’s projected fiscal deficit for this year.

Following a significant decrease in U.S. Treasury yields since October, many borrowers are trying to secure lower financing costs.

Although the Federal Reserve is anticipated to begin reducing interest rates this year, which would further lower yields, this is unlikely to occur for a few more months.

Saudi Arabia sold notes with terms of six, 10, and 30 years at yields of 4.89, 5.13, and 5.91 per cent respectively. In comparison, 10-year U.S. Treasuries are trading at around 4 per cent.

The primary banks overseeing the Saudi sale were Citigroup Inc., JPMorgan Chase & Co., HSBC Holdings Plc, and Standard Chartered Plc.