Egypt’s stock market incurred in a week losses totalling 1.1 billion pounds amid lacklustre performance. However, the country’s main stock index – EGX30 grew 3.9%, closing the week at highest levels since September 2008.

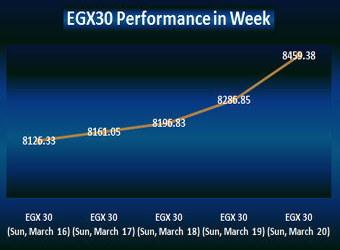

The Egyptian Exchange’s benchmark index EGX30 index inched up by 3.9% in a week, registering a surge of 319.34 points, ending Thursday’s transactions at 8459.39 points compared to 8140.05 points at the end of a week earlier.

The main gauge index registered its highest point on Thursday closing at 8459.39 points, where its lowest point recorded on Sunday at 8126.33 points.

On the contrary, the mid- and small-cap index, the EGX70 sank by 2.7% closing at 633.63 points during Thursday’s session, compared to 651.12 points at the end of a week earlier. The price index, EGX100 also fell by 0.1% concluding by 1104.44 points during Thursday’s session, against 1115.57 points at the end of a week earlier.

Turnovers & Traded Volumes:

Through the week, the trading volume hit around 1.7 billion securities, compared to 1.5 billion securities at the end of a week earlier. For the traded value, it reached EGP 6 billion against EGP 5.9 billion a week earlier.

Sectors Activity:

Financial Services excluding Banks sector was the most active sector through last week, recording a volume of trades of 499.1 million securities worth EGP 1.621 billion.

Telecommunications came second, attaining a volume of trades of 497.3 million securities worth EGP 986.3 million.

Real Estate reported third, with a volume of trades of 200.3 million securities worth EGP 1.039 billion.

Travel & Leisure sector was on the fourth position, getting a volume of trades of 146.3 million securities worth EGP 369.5 million.

Personal and Household Products sector came fifth, recording a volume of trades of 135.1 million securities worth EGP 601.6 million.

Industrial Goods and Services and Automobiles reported sixth, having a volume of trades of 117.3 million securities worth EGP 301.3 million.

Construction and Materials was on the seventh position, with a volume of trades of 67.1 million securities worth EGP 544.2 million.

Food and Beverage reported eighth, attaining a volume of trades of 33.6 million securities worth EGP 166.8 million.

Banks took the ninth position, with a volume of trades of 13.7 million securities worth EGP 373.3 million.

Basic Resources reported tenth, recording a volume of trades of 12.1 million securities worth EGP 181 million.

Healthcare and Pharmaceuticals sector ranked eleventh, attaining a volume of trades of 11.6 million securities worth EGP 28.7 million.

At the bottom of the list, Chemicals reported twelfth getting a volume of trades of 5.5 million securities worth EGP 78.6 million.

Investors’ Activity:

Local investors led the market activity all through the week with 82.68%, followed by Foreign and Arab investors with 9.33% and 8%, respectively, after excluding the deals.

Foreign investors were the most active buyers during the week earning the value of 261.58 million, after excluding the deals.

Arab investors were to sell by value of EGP 180.82 million, after excluding the deals.

Moreover, institutions seized 35.65% of total trading through the week; while individuals attained 64.35% . Institutions were the most active buyers during the week earning the value of EGP 118.84 million, after excluding the deals.