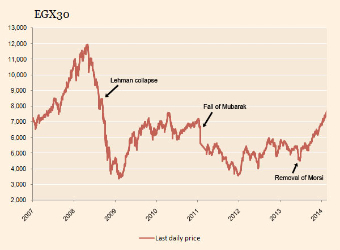

Who says military rule is bad for stock markets? The EGX30, Egypt’s main stock index, is now over 7,700 – a level not seen since mid-2008, according to the latest report by The Financial Times on Tuesday.

“The index has surpassed the previous post-Lehman high before the removal of president Mubarak, which was just over 7,600 in April 2010.” The report said

“The pre-Lehman peak of nearly 11,000 is still some way off. And the last time the index was at this level, it was on the way down, not up, of course. But it’s still another milestone.”

The UK paper further referred the strange thing is that Egypt isn’t exactly in great shape. General Sisi, who is likely to run for president in elections later this year, is something of an unknown quantity. And although the violence and unrest has calmed down, the deadly attack on a bus carrying tourists last weekend was a reminder that it is not that far away.

Rating agency Fitch may have put the country on a “stable” footing in its recent sovereign review, but the economy is still sluggish, it noted. Growth remains far below the rates needed to bring the unemployment rate down. Capital Economics pointed out in a note on Tuesday that GDP of around 4.5 per cent is needed to reduce the jobless rate, whereas current growth is around 2 per cent.

According to the state statistics organisation CAPMAS, unemployment in the fourth quarter was stable at 13.4 per cent, although youth unemployment is now 69 per cent.

But still the market rises, up 70 per cent since the coup that removed Mohamed Morsi in 2013.

The question is, who is driving the rally? Up until now, it has been mainly local investors, who are encouraged by the relative political stability, as well as the financial support from the Gulf.

Simon Kitchen, strategist at EFG-Hermes, the Cairo-based regional investment bank, says that the billions from the Gulf states has pushed interest rates on the Egyptian pound lower, so some money is switching from local government treasury bills to equities. “Financial support has smoothed over some of the worries,” he says.

However, Kitchen suggests that the new-found confidence in local portfolio managers has yet to catch on with foreign investors. “They are comfortable with [the idea of] a cyclical recovery, but there is still the problem of repatriating foreign currency.”

And the de facto capital controls also act as another spur to Egyptian investors to put money into equities, as it is hard for locals to get foreign currency.

So will the rally continue? Without any major upheaval or political shocks, local investors could push prices up further.

But as Kitchen says: “for a sustained rally, you need to see foreign money come in. We are not seeing that right now.”