Powered by the return of investors’ confidence in Egypt’s market, Egyptian stocks gained in Week around 8.1 billion Egyptian pounds. The main stock index – EGX30 crossed 8100 points.

Last week trading sessions coincidence with of former army chief Abdel Fattah al-Sisi’s submission of his presidential candidacy papers.

On Tuesday, former army chief Abdel-Fattah El-Sisi submitted 200,000 recommendation forms to the Presidential Elections Commission to become the first presidential runner to complete all the required paperwork for electoral eligibility.

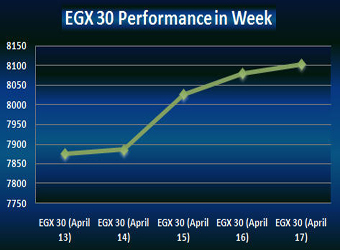

Back to the performance of the Egyptian Exchange’s indices throughout last week trading sessions, the EGX30 surged by 2.6% in a week, registering an increase of 204.21 points, ending Thursday’s transactions at 8103.67 points compared to 7899.46 points at the end of a week earlier.

The main gauge index registered its highest point on Thursday closing at 8103.67 points, whereas its lowest point recorded on Sunday at 7875.22 points.

In addition, the mid- and small-cap index, the EGX70 inched up by 1.9% closing at 606.45 points during Thursday’s session, compared to 595.39 points at the end of a week earlier. The price index, EGX100 also increased by 1.7% concluding by 1062.11 points during Thursday’s session, against 1043.99 points at the end of a week earlier.

Furthermore, the market capitalization closed at EGP 477.628 billion last Thursday, compared to EGP 469.516 billion at the end of a week earlier.

Turnovers & Traded Volumes:

Through the week, the trading volume hit around 1.2 billion securities, compared to 1.3 billion securities at the end of a week earlier. For the traded value, it reached EGP 5.5 billion against EGP 5.6 billion a week earlier.

Sectors Activity:

Telecommunications sector was the most active sector through last week, recording a volume of trades of 376.2 million securities worth EGP 562.6 million.

Financial Services excluding Banks sector came second, attaining a volume of trades of 336.5 million securities worth EGP 986.4 million.

Travel & Leisure sector reported third, with a volume of trades of 111.1 million securities worth EGP 238.3 million.

Real Estate was on the fourth position, getting a volume of trades of 104.7 million securities worth EGP 585.5 million.

Industrial Goods and Services and Automobiles came fifth, recording a volume of trades of 72.6 million securities worth EGP 138.3 million.

Personal and Household Products sector reported sixth, having a volume of trades of 66 million securities worth EGP 324.2 million.

Construction and Materials was on the seventh position, with a volume of trades of 47.4 million securities worth EGP 186.3 million.

Basic Resources reported eighth, attaining a volume of trades of 15.5 million securities worth EGP 190.5 million.

Food and Beverage took the ninth position, with a volume of trades of 13 million securities worth EGP 63.9 million.

Chemicals reported tenth, recording a volume of trades of 5.7 million securities worth EGP 82.8 million.

Banks ranked eleventh, attaining a volume of trades of 4.8 million securities worth EGP 150.3 million.

At the bottom of the list, Healthcare and Pharmaceuticals sector reported twelfth getting a volume of trades of 4.2 million securities worth EGP 30.3 million.

Investors’ Activity:

Local investors led the market activity all through the week with 88.01%, followed by Foreign and Arab investors with 5.28% and 6.71%, respectively, after excluding the deals.

Foreign investors were the most active buyers during the week earning the value of EGP 37.93 million, after excluding the deals.

Arab investors were to sell by value of EGP 75.79 million, after excluding the deals.

Moreover, institutions seized 47.14% of total trading through the week; while individuals attained 52.86% . Institutions were the most active buyers during the week earning the value of EGP 146.83 million, after excluding the deals.

Market Remarks

– EGX: Trading Halted Sunday, Monday for Easter Holidays

The Egyptian Exchange (EGX) said trading activities will be halted on Sunday, April 20 and Monday, April 21, 2014 for the Easter holidays.

Trading activities will be resumed on Tuesday, April 22, 2014.

– Egypt Cabinet Sponsors EGX IPO Summit 2014 on May 6

The Egyptian Exchange’s upcoming IPO Summit will be held under the patronage of the country’s government next May 6.

This comes as Egypt’s Prime Minister Ibrahim Mehleb approved to sponsor the EGX IPO Summit 2014 after his Excellency’s meeting with the country’s bourse as well as market regulator chiefs Monday afternoon.

Mehleb met with Dr. Mohamed Omran, EGX Chairman, and Dr. Sherif Samy, Chairman of the Egyptian Financial Supervisory Authority (EFSA), discussing mechanisms for boosting the capital market. In addition, the prime minister also tackled methods for alluring more companies to get listed on the EGX, in which the state’s development and infrastructure projects can benefit from the stock market for finance.

The EGX is organizing its first IPO conference on May 6, 2014. This conference would be largest gathering of all market parties who are interested in the initial public offerings; including investment banks, law houses, auditors, with potential issuers.

Meanwhile, Amwal Al Ghad is set to be the media sponsor for the EGX IPO Summit 2014.

The event is set to give a better insight about listing on the EGX and its benefits to the growth of the company’s businesses.