During Thursday opening session, the Egyptian Exchange (EGX) has posted early losses of EGP 1.67 billion as the capital market has amounted to EGP 394.988 million, according to data compiled by Amwal Al Ghad at 11:04 a.m. Cairo time (09:04 GMT).

EGX indices opened in red.

The main index, EGX30 slumped by 0.51% to hit 5725.8 p. EGX20 fell by 0.83% to reach 6641.57 p.

Meanwhile, the mid- and small-cap index, the EGX70 dropped by 0.82% to hit 529.45 pts. Price index EGX100 dipped by 0.76% to reach 882.56 p.

Traded volume reached 16.815 million securities worth EGP 35.327 million, exchanged through 2.132 thousand transactions.

This was after trading in 98 listed securities; 58 declined 16 advanced while 24 keeping their previous levels.

EGX’s early losses were backed by Egyptians’ profit-taking deals.

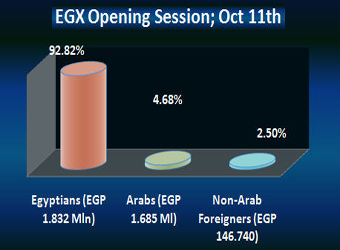

Arabs and non-Arab Foreigners were net buyers seizing 4.68% and 2.5% respectively, of the total markets, with a net equity of EGP 1.685 million and EGP 146.740 thousand excluding the deals.

On the other hand, Egyptians were net sellers seizing 92.82% of the total markets, with a net equity of EGP 1.832 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance during early trading.

Citadel Capital:

Citadel Capital (CCAP.CA)’s stock tumbled by 1.48% to reach EGP 4.00.

Citadel Capital Chairman and Founder Ahmed Heikal said the firm has already invested $4 billion in Egypt since January 2011, when an uprising erupted that toppled President Hosni Mubarak. Citadel has an eye on infrastructure and energy-related projects, he added during Euromoney conference on Tuesday.

“I met a number of government officials and we think we are ready to invest a significant amount of money, probably higher than the $4 billion over the next three years,”

“We identified a number of opportunities in the energy efficiency, infrastructure sphere,” he said.

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) went down by 1.27% to hit EGP 11.70.

Egypt’s financial regulator said on Wednesday it would decide next week on whether to approve plans by Egypt’s biggest investment bank EFG-Hermes (HRHO.CA) to tie up with Qatar’s QInvest.

EFG-Hermes and QInvest sealed the agreement in May to hive off EFG-Hermes’s investment banking business in a joint venture in which state-backed QInvest would hold a 60 percent stake.

“We will take our decision next week,” Ashraf El-Sharkawy, chairman of the Egyptian Financial Supervisory Authority (EFSA), told Reuters, when asked if EFSA would approve the plan by EFG-Hermes and Qinvest for an investment bank.

He did not give further details.

In September, Shareholders in EFG-Hermes reaffirmed their approval of the tie-up after demands by the regulator for more details were met. EFSA had rejected decisions approved by shareholders in June because the firm had not clarified points including minority rights.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) inched lower by 0.56% to reach EGP 3.53.

Orascom Construction Industries:

Trading was resumed for Orascom Construction Industries – OCI (OCIC.CA) during Wednesday. The stock pushed down by 0.46% to hit EGP 278.99.

Trading resumption was after OCI has sent clarifications to the EGX.

Commenting on the news published by Amwal Al Ghad, Omar Derwaza – Head of Investor Relations at Orascom Construction Industries (OCI) – has asserted that the Egyptian Tax Authority has called for holding a meeting with the Group officials without mentioning the main reasons behind that request.

Derwaza expected that the meeting will discuss what the Egyptian President Mohamed Morsi had said during October war victory celebrations regarding the five EGX-listed companies which are accused of evading to pay the taxes through the last years.

The EGX Chairman Mohamed Omran said early Wednesday the bourse has suspended trading in Orascom Construction Industries (OCI) – (OCIC.CA)’s stocks awaiting the firm’s comments on the news published by Amwal Al Ghad regarding its EGP 14 billion tax fraud.

Egyptian Tax Authority sources told Amwal Al Ghad that the authority had called the Egyptian tycoon Onsi Sawiris alongside his son Nassif Sawiris to start interrogations regarding Orascom Construction Industries (OCI) – (OCIC.CA)’s evading to pay EGP 14 billion tax dues to the state.

The Egyptian Tax Authority has decided to call the Egyptian tycoon Onsi Sawiris and his son Nassif Sawiris to start interrogations regarding Orascom Construction Industries (OCI) – (OCIC.CA)’s evading to pay EGP 14 billion tax dues to the state.

President Morsi stated Saturday that Egypt is owed about EGP 100 billion by five companies adding that the state is in talks with these entities to have its dues. The President clarified that some of these dues arose from financial irregularities or tax evasions.

The sources further told Amwal Al Ghad that the selling deal of OCI’s Orascom Building Materials Holding to French Lafarge in 2008 has been reviewed referring that the deal has violated the law leading to tax fraud.

It is worth mentioning that OCI sold in 2007 its entire stake in Orascom Building Materials Holding (OBMH) to French Lafarge at $ 12.9 billion.

The tax sources added that OCI had founded Orascom Building and had listed it in the EGX for a short while, transferring to it the Lafarge deal valued at EGP 71 billion.

On the other hand, OCI noted on Monday that the capital gains from selling its entire stakes in the EGX-listed Orascom Building Materials Holding to Lafarge are tax exempt.

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA) maintained with no change at EGP 0.54.