During Tuesday midday session, the Egyptian Exchange (EGX) has posted losses of EGP 2.2 billion as the capital market has amounted to EGP 393.205 billion, according to data compiled by Amwal Al Ghad at 12:57 p.m. Cairo time (10:57 GMT).

EGX indices went in red.

The main index, EGX30 fell by 0.42% to hit 5626.61 p. EGX20 inched lower by 0.59% to reach 6596.01 p.

Meanwhile, the mid- and small-cap index, the EGX70 sank by 1.38% to hit 534.45 pts. Price index EGX100 dropped by 1.08 % to reach 883.3 p.

Traded volume reached 84.467 million securities worth EGP 281.020 million, exchanged through 17.861 thousand transactions.

This was after trading in 163 listed securities; 135 declined 21 advanced while 7 keeping their previous levels.

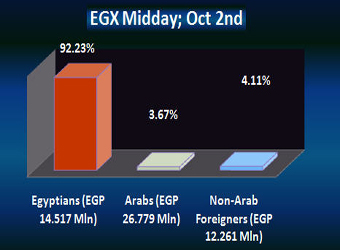

EGX’s midday losses were backed by Egyptians and non-Arab Foreigners’ selling pressures.

Egyptians and non-Arab Foreigners were net sellers seizing 92.23% and 4.11% respectively, of the total markets, with a net equity of EGP 14.517 million and EGP 12.261 million excluding the deals.

On the other hand, Arabs were net buyers seizing 3.67% of the total markets, with a net equity of EGP 26.779 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance during midday trading.

Citadel Capital:

Citadel Capital (CCAP.CA) maintained with no change at EGP 4.16.

Citadel Capital’s Managing Director announced late Monday that it intends to inject $2.5 billion in a projected oil refinery in east Africa’s third-largest economy Uganda

Uganda has said it intends to build a refinery once it starts producing crude oil, and it recently raised its estimated oil reserves to 3.5 billion barrels from 2.5 billion barrels.

Citadel secured $3.7 billion in financing for an Egyptian petroleum refinery project in June, and the firm’s managing director Karim Sadek said the company is now looking at refining potential deals in sub-Saharan Africa, including Uganda.

“Yes, we would be interested,” Sadek told Reuters in Nairobi, where he addressed a business club. “We know very well what’s happening on the Ugandan oil side and we’ve had discussions before.”

He said Citadel never invests in projects without a local partner, and he would not be drawn on the size of the investment the private equity group might make since the refinery plans are still in their infancy.

Uganda has outlined plans to build a refinery in Hoima, about 220 km west of its capital Kampala, and in July the government said it was aiming to take up to a 40 per cent stake in the plant with a private investor acquiring the remaining 60 per cent.

Uganda says it wants a facility with a maximum output of 120,000 barrels per day before production can commence, and that it intends to develop the project in phases, starting with a refining capacity of 20,000 barrels.

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA) dived by 1.92% to hi EGP 0.51.

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) tumbled by 0.71% to hit EGP 11.24.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) inched lower by 0.28% to reach EGP 3.55.

Orascom Construction Industries:

Orascom Construction Industries (OCIC.CA) went up by 0.06% to reach EGP 279.00.

Orascom Construction Industries announced Sunday that the Group will be finalizing the actual demerger process between its construction activities and its fertilizer arm within the coming November.

Omar Derwaza, Head of Investor Relations at OCI, said the Group has finalized all the necessary procedures for the demerger. OCI had completed outlining the demerger mechanisms alongside the situation of its two activities (Construction and Fertilizer) after the final demerger, Derwaza added.

Derwaza has also stated that OCI plans to finalize its demerger process with the coming November proceeded by the launch of the two firms; the Demerging Company (OCI Fertilizers) and the Demerged Company (Orascom Engineering and Construction).

The Group will inform the Egyptian Financial Supervisory Authority (EFSA) of any further updates about the demerger process, he noted.