The Egyptian Exchange (EGX) has ended Wednesday’s session incurring losses of EGP 1.2 billion driven by local and Arab selling pressures. The capital market has reached to EGP 380.108 billion during Wednesday’s closing.

The EGX indices ended in red.

Egypt’s benchmark index EGX 30 ended Wednesday on a red note as it inched down by 0.24% to end at 5609.32 p; while EGX20 fell by 0.54% to close 6513.67 p.

Meanwhile, the mid- and small-cap index, the EGX70 went down by 0.87% to conclude at 475.78 pts. Price index EGX100 dropped by 0.69% to finish at 805.64 p.

During Wednesday’s closing, the trading volume hit 76.897 million securities worth EGP 327.831 million, exchanged 19.032 thousand transactions.

This was after trading in 164 listed securities; 110 declined, 19 advanced; while 35 keeping their previous levels.

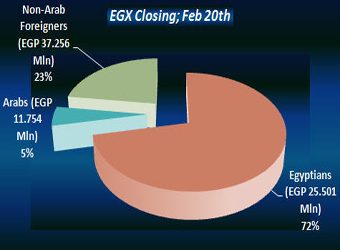

Arab and local selling pressures drove EGX’s closing losses as Egyptians and Arabs were net sellers seizing 71.75% and 5.47% respectively, of the total markets, with a net equity of EGP 25.501 million and EGP 11.754 million excluding the deals.

Meanwhile, the non-Arab foreigners were net buyers seizing 22.79% of the total markets, with a net equity of EGP 37.256 million excluding the deals.

With the economy in crisis, the Egyptian government is under pressure to rein in a deficit enlarged by energy subsidies that account for a fifth of the budget. The government must curb the subsidies to secure a vital $4.8 billion International Monetary Fund loan, economists say.

In the official gazette the government said the price of fuel oil, which is widely used in energy-intensive local industries, would be 1,500 Egyptian pounds ($220) per tonne.

This would apply for all industries other than bakeries, electricity producers and food manufacturers to be named by the ministry of industry.