During Sunday closing session, the Egyptian Exchange (EGX) has posted losses of EGP 1.59 billion as the capital market has amounted to EGP 394.574 million.

EGX indices closed in red except for the EGX20.

The main index, EGX30 fell by 0.28% to close at 5723.11 p. EGX20 rose by 0.14% to finish at 6675.82 p.

Meanwhile, the mid- and small-cap index, the EGX70 inched lower by 0.83% to conclude at 529.56 pts. Price index EGX100 went down by 0.67% to end at 881.14 p.

Traded volume reached 103.952 million securities worth EGP 382.827 million, exchanged through 24.430 thousand transactions.

This was after trading in 179 listed securities; 120 declined 42 advanced while 17 keeping their previous levels.

EGX’s losses were due to Egyptians’ profit-taking deals.

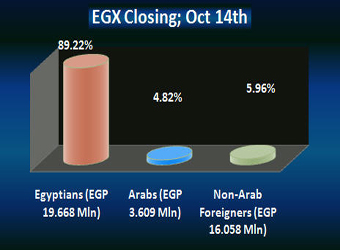

Egyptians were net sellers seizing 89.22% of the total markets, with a net equity of EGP 19.668 million excluding the deals.

On the other hand, non-Arab Foreigners and Arabs were net buyers seizing 5.96% and 4.82% respectively, of the total markets, with a net equity of EGP 16.058 million and EGP 3.609 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed unsteady performance during the closing.

Citadel Capital:

Citadel Capital (CCAP.CA)’s stock surged by 1.92% to close at EGP 4.24.0

SODIC:

Six of October Development & Investment Company – SODIC – (OCDI.CA)’s stock rose by 1.85% to conclude at EGP 22.53.

SODIC has reported total sales of its flagship Allegria residential project of EGP 440 million during the first nine months of 2012. Allegria project is established on an area of 2.8 million meter square, locates in Sheikh Zayed city.

Sources from SODIC told Amwal Al Ghad that during the first nine months of 2012, around 90 new units have been contracted in which 60% were delivered. Delivery progress is on track before the end of 2013.

The sources further added that in mid of last July, the New Urban Communities Authority (NUCA) approved SODIC’s request for having extra two years so as to complete the two phases of Allegria project (phases III and V).

EFG-Hermes:

EFG-Hermes Holding (HRHO.CA) went up by 0.60% to finish at EGP 11.78.

Egypt’s financial regulator said on Wednesday it would decide next week on whether to approve plans by Egypt’s biggest investment bank EFG-Hermes (HRHO.CA) to tie up with Qatar’s QInvest.

EFG-Hermes and QInvest sealed the agreement in May to hive off EFG-Hermes’s investment banking business in a joint venture in which state-backed QInvest would hold a 60 percent stake.

“We will take our decision next week,” Ashraf El-Sharkawy, chairman of the Egyptian Financial Supervisory Authority (EFSA), told Reuters, when asked if EFSA would approve the plan by EFG-Hermes and Qinvest for an investment bank.

He did not give further details.

In September, Shareholders in EFG-Hermes reaffirmed their approval of the tie-up after demands by the regulator for more details were met. EFSA had rejected decisions approved by shareholders in June because the firm had not clarified points including minority rights.

Orascom Telecom Media & Technology Holding:

Orascom Telecom Media & Technology Holding (OTMT.CA) dipped by 1.85% to end at EGP 0.53.

Orascom Construction Industries:

Orascom Construction Industries – OCI (OCIC.CA)’s stock went down by 1.09% to end at EGP 274.38.

Mohamed Fayzi, Head of Tax Evasion at Egyptian Tax Authority said officials at OCI asked for postponing a meeting that was scheduled for last Thursday to submit documents clearing the leading EGX-listed company from charges of tax evasion as regards the selling of whole shares in Orascom Building Materials Holdings to France-based Lafarge.

The meeting was rescheduled for Sunday.

Trading was resumed for OCI during Wednesday. The stock pushed down by 1.03% to end at EGP 277.39.

Trading resumption was after OCI has sent clarifications to the EGX.

On Wednesday, the Egyptian Tax Authority sources told Amwal Al Ghad that the authority had called the Egyptian tycoon Onsi Sawiris alongside his son Nassif Sawiris to start interrogations regarding Orascom Construction Industries (OCI) – (OCIC.CA)’s evading to pay EGP 14 billion tax dues to the state.

The Egyptian Tax Authority has decided to call the Egyptian tycoon Onsi Sawiris and his son Nassif Sawiris to start interrogations regarding Orascom Construction Industries OCI’s evading to pay EGP 14 billion tax dues to the state.

President Morsi stated Saturday that Egypt is owed about EGP 100 billion by five companies adding that the state is in talks with these entities to have its dues. The President clarified that some of these dues arose from financial irregularities or tax evasions.

The sources further told Amwal Al Ghad that the selling deal of OCI’s Orascom Building Materials Holding to French Lafarge in 2008 has been reviewed referring that the deal has violated the law leading to tax fraud.

It is worth mentioning that OCI sold in 2007 its entire stake in Orascom Building Materials Holding (OBMH) to French Lafarge at $ 12.9 billion.

The tax sources added that OCI had founded Orascom Building and had listed it in the EGX for a short while, transferring to it the Lafarge deal valued at EGP 71 billion.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) dropped by 0.56% to conclude at EGP 3.57.