During Tuesday closing session, the Egyptian Exchange (EGX) has extended its early gains to eventually reach EGP 2.27 billion as the capital market has amounted to EGP 367.631 billion.

The main index, EGX30 rose by 0.83% to end at 5325.36 p. EGX20 climbed by 0.75% to close at 6215.86 p.

Meanwhile, the mid- and small-cap index, the EGX70 surged by 1.12% to conclude at 489.37 p. Price index EGX100 inched higher by 0.49% to finish at 825.82 p.

Traded volume reached 226.866 million securities worth EGP 795.854 million, exchanged 35.078 thousand transactions.

This was after trading in 184 listed securities; 49 declined 124 advanced while 11 keeping their previous levels.

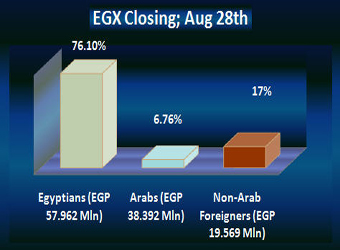

The main reason behind EGX30’s upwards was that Egyptians were net buyers 76.1% of the total markets, with a net equity of EGP 57.962 million excluding the deals.

On the other hand, non-Arab Foreigners and Arabs were net sellers seizing 17.14% and 6.76% respectively, of the total markets, with a net equity of EGP 19.569 million and EGP 38.392 million excluding the deals.

Leading Shares:

EGX’s leading shares witnessed collective upwards except for the shares of Talaat Moustafa Group (TMGH.CA) slumped by 1.08% to end at EGP 4.58.

Citadel Capital:

Citadel Capital (CCAP.CA) led EGX upwards as they climbed by 2.13% to finish at EGP 3.36.

Commercial International Bank:

The shares of Commercial International Bank- Egypt (CIB) (COMI.CA) soared by 1.90% to end at EGP 30.08.

Egypt’s central bank sold 513 million euros ($642 million) worth of euro-denominated T-bills at an inaugural auction on Tuesday, and foreign investors took up 20 percent of the issue, the bank said.

It was the first time for the central bank to sell euro T-bills. In November it introduced T-bills denominated in U.S. dollars and has sold $5.83 billion of those bills in six auctions so far.

The central bank noted the level of demand from foreign investors. There was no foreign participation in the June 19 dollar T-bill auction and intermittent participation in previous issues, the bank said.

Foreign investors have largely held back from buying Egyptian securities since last year’s popular uprising, forcing the government to turn mainly to the local money market to finance a budget deficit of around 8 percent of gross domestic product.

This has stretched the ability of local banks to lend to the government Egyptian pounds to their limit.

Orascom Telecom Holding:

Orascom Telecom Holding (OTH) (ORTE.CA) surged by 1.67% to conclude at EGP 3.66.

EFG-Hermes Holding:

Shares of EFG-Hermes Holding (HRHO.CA) inched up by 0.94% to close at EGP 11.85.

As EFG-Hermes (HRHO.CA) is finalizing procedures required by the Egyptian Financial Supervisory Authority (EFSA) to complete QInvest’s acquisition of 60% of its core operations, EFSA demanded Tuesday the Prosecution of the Financial and Commercial Affairs to make investigations and file a criminal complaint against Planet IB.

EFSA investigations revealed that Planet IB alliance violated the Capital Market Law and procedures relevant to acquiring EGX-listed companies.

The investigations also revealed that Planet IB was founded after announcing the acquisition plan. Planet had no legal entity when it notified Hermes and EFSA of the purchase plan.

EFG-Hermes said Sunday it will announce the date of its extraordinary shareholders meeting with a week. EFG-Hermes added that its ESM aims to provide its shareholder with all the disclosures and details; QInvest buyout deal in particular regarding the acquisition of 60% of Hermes stakes.

EFG-Hermes official source noted that once the group obtains the shareholders’ approvals, all the necessary procedures to conclude QInvest acquisition deal would be then completed.

Dr. Ashraf Al-Sharkawy, EFSA chairman, had stated that EFG-Hermes did not provide the required information and further disclosures including the fate of minority rights after the deal is completed as well as the financial mechanism regarding dividend distribution.

Al-Sharkawy noted that the EFSA has asked EFG-Hermes for more disclosures including the future of the group, its capital and fate of its minority, but it did not respond yet.

Orascom Construction Industries:

Orascom Construction Industries (OCIC.CA) rose by 0.93% to finish at EGP 278.65.

Orascom Telecom Media & Technology Holding:

Shares of Orascom Telecom Media & Technology Holding (OTMT.CA) returned to its Monday levels at EGP 0.58.