Chinese artificial intelligence company Megvii has filed for an initial public offering on Hong Kong stock exchange.

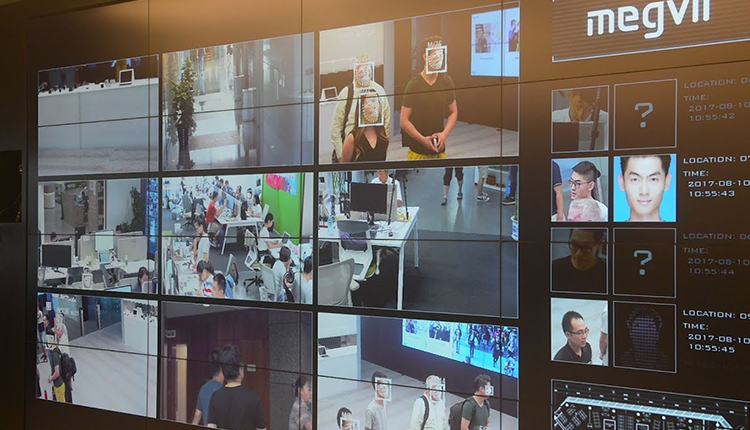

The company is backed by e-commerce giant Alibaba alongside state-owned enterprises such as Bank of China Group Investment, the bank’s private equity arm. Megvii sells AI products from facial recognition technology to algorithms designed for traffic management.

It has not disclosed any details yet about the pricing of its shares or the timeline of its IPO. But the company has signalled confidence in the Hong Kong stock market despite the ongoing protests and a recent report that Alibaba has put off its listing there.

Earlier this year, Megvii completed a $750 million funding round, reportedly putting its valuation north of $4 billion. Its closest rival, Sensetime, has a valuation at over $4.5 billion.

Widening losses

Facial recognition is a key part of China’s drive to become a world leader in the AI technology by 2030, and both companies are benefitting from that as the technology has been deployed in cities across China. The Chinese government is one of its key customers.

This has helped Megvii witness fast revenue growth. The company generated 1.42 billion yuan ($199.7 million) in revenue in 2018, an increase of more than 350 percent. In the first six months of 2019, Megvii raked in 948.9 million yuan.

However, losses have continued to widen. Megvii incurred a loss of 3.35 billion yuan in 2018, compared to 758.8 million in 2017. In the first six months of this year alone, the company’s losses stood at 5.2 billion yuan — more than the amount it lost throughout 2018. Megvii attributed this to continued investment in research and development.

Trade war risks

Megvii outlined a number of risks for its business, from ballooning research and development costs to negative publicity relating to facial recognition technology. For instance, a recent report from Human Rights Watch linked Megvii to China’s mass surveillance of the minority Uighur population in Xinjiang. The report was later corrected to show Megvii was not involved.

“Although the allegations made by the report in relation to our involvement with the misuse of our technologies were proven to be wrong … such report had still caused significant damages to our reputation which are difficult to completely mitigate,” Megvii’s prospectus said, without explicitly naming the Human Rights Watch study.

The company also referred to a number of risks around the escalating U.S.-China trade war.

In May, reports surfaced that Megvii could be one of a handful of Chinese surveillance companies that could be put on a U.S. blacklist which would restrict American companies from selling technology to them. While the U.S. government has not made an official announcement about this, Megvii said if it were to happen, the company’s ability “to develop and provide our solutions might be impaired.”

However, the U.S. has blacklisted Chinese telecom equipment maker Huawei Technologies, which has some business ties with Megvii.

Huawei is important for the supply chain to various industries such as telecommunications and consumer electronics., and a longer-term ban on Huawei will have knock-on effects for others such as Megvii.

“Prolonged restrictions against Huawei could cause a turmoil to all such industries, which may in turn materially and adversely affect our business, financial condition and results of operations,” Megvii said.

Over the weekend, China introduced new tariffs of between 5 percent and 10 percent on $75 billion of goods from the U.S. In response, U.S. President Donald Trump increased duties on imports from China. The intensifying trade war is a concern for Megvii.

“Any escalation in trade tensions or a trade war, or the perception that such escalation or trade war could occur, may have tremendous negative impact on the economies of not merely the two countries concerned, but the global economy as a whole,” its IPO prospectus said.

“In addition, if China were to increase the tariff on any of the items imported by our suppliers and contract manufacturers from the U.S., they might not be able to find substitutes with the same quality and price in China or from other countries, Megvii said. “As a result, our costs would increase and our business, financial condition and results of operations would be adversely affected.”

Source: CNBC