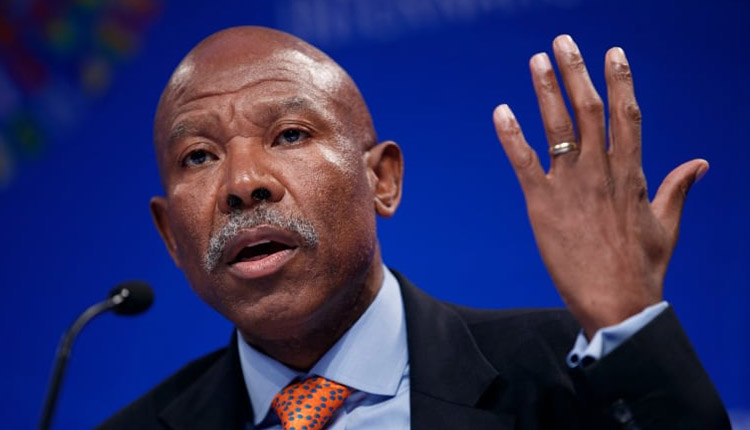

“While we expect to see a pickup [in growth] next year, trade tensions, geopolitical risks, political instability are among the challenges,” Lesetja Kganyagom, chairman of the International Monetary and Financial Committee(IMFC)and the South African Reserve Bank’s governor, said at a press conference.

“We agreed we need to act promptly to protect the expansion.”

“Fiscal policy for example should remain flexible and growth-friendly, rebuild buffers, and strike the right chord between debt sustainability and supporting demand,” Kganyago said, capping the spring meetings of the IMF and World Bank in Washington.

He also added that strong fundamentals, sound policies, and a resilient international monetary system are essential to the stability of exchange rates, contributing to strong and sustainable growth and investment.

In addition, Flexible exchange rates, where feasible, can serve as a shock absorber, referring that excessive volatility or disorderly movements in exchange rates can have adverse implications for economic and financial stability.

Advancing financial and structural reforms is critical to boosting potential growth and employment, enhancing resilience, and promoting inclusion, he further noted.

He pointed out the importance of commitment to strong governance, including by tackling corruption, in addition to implement policies that foster innovation and fair market competition.