Egypt needs to implement economic reforms aimed at encouraging more private investment and moving away from subsidies towards targeted transfers for the poor, a senior World Bank official announced on Wednesday.

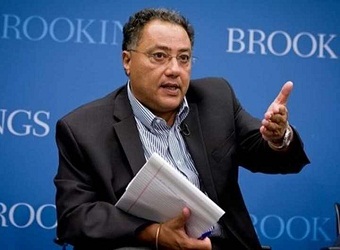

Hafez Ghanem, the World Bank’s vice president for the Middle East and North Africa, told Reuters in an interview that Cairo’s next set of economic reforms should focus on making its bureaucracy more transparent for investors.

Such reforms are important as part of a wider transition across the Middle East away from a social model based on free government handouts to one more dependent on private sector development, Ghanem said.

He added that the appointment of a new government in Lebanon had eased political gridlock and said he believed donors were still committed to tackling Syria’s refugee crisis despite a shift towards economic nationalism in some western countries.

The World Bank said in December that its board had approved the second $1 billion tranche of a $3 billion loan package to Egypt. Ghanem told Reuters he expected to work with Cairo towards approving the third tranche near the end of this year.

“We need to see a big increase in private investment, and not just private investment by big companies, big ticket items. We need to see encouragement for SMEs, for young people to develop more entrepreneurship,” he said.

“The next set of reforms need to focus on the micro level, regulatory reforms, making the system more transparent, easier for investors to come and invest in Egypt,” he added.

He also praised Egypt’s reforms so far.

“The actions on the macro economic side, on the exchange rate side, were key to making it more attractive for businesses to invest, to have access to foreign exchange, to be able to import, to be able to move their profits back,” he added.

OIL PRICES

Most regional economies have struggled to manage the impact of lower oil prices in recent years, he said. While oil producers are working to diversify their economies, importers have also been hit by falling revenue from remittances, aid, investment and tourism from Gulf states.

“Their import bill comes down but… the net impact on the Arab oil importers is not necessarily positive,” he said.

However, Lebanon’s appointment of a new president and cabinet last year, its resumption of regular parliament sessions and its efforts to pass a budget for the first time since 2005 were cause for optimism, he said. He was speaking to Reuters during a visit to the Lebanese capital Beirut.

Signs of a loosening up of the political deadlock have allowed much of a $1 billion package that had already been pledged to Lebanon to move forward, he said, including the nearly $500 million earmarked for the Bisri dam and water supply project aimed at reducing shortages in Beirut.

Lebanon and Jordan are two of the main hosts for Syrian refugees, part of the world’s biggest displacement crisis since the Second World War, which has put significant stress on both countries’ economies as well as their social models.

The World Bank’s aid to the two countries for helping refugees mixes grants and loans offered at lower-than-usual rates, Ghanem said. While some projects focus on education, health and infrastructure, others are aimed at job creation.

One such project jointly carried out by the Jordanian government, the World Bank and the European Union has set up special economic zones producing goods that can be imported more easily into Europe.

Although both Lebanon and Jordan have imposed measures to prevent Syrians integrating into their already stretched labour markets, such special economic zones will allow employment of refugees as well as locals, Ghanem said, and aimed to create 200,000 jobs.

Source: Reuters