In a week, Egyptian shares attained remarkable gains in the amount of EGP 7.5 billion powered by a military green light given to the country’s defence minister on Tuesday to run for presidency. Marking an optimistic economic indicator, Egypt’s benchmark index hit throughout last week, its highest point in 3 years and half, since April 2010.

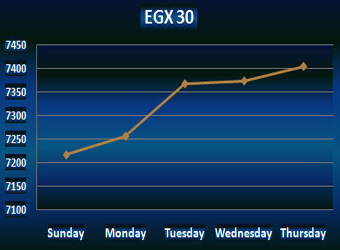

The Egyptian Exchange’s benchmark index EGX 30 index surged by 2.4% this week, registering a surge of 171.87 points, ending Thursday’s transactions at 7405.25 points compared to 7233.38 points at the end of a week earlier.

The main gauge index registered its highest point on Thursday closing at 7405.25 points, where its lowest point recorded on Sunday at 7217.82 points.

Meanwhile, the mid- and small-cap index, the EGX70 soared by 3.5% closing at 584.62 points during Thursday’s session, compared to 565.15 points at the end of a week earlier. The price index, EGX100 also pushed up by 3.4% concluding by 992.2 points during Thursday’s session, against 959.67 points at the end of a week earlier.

Furthermore, the market capitalization closed at EGP 451.912 billion last Thursday, compared to EGP 444.450 billion at the end of a week earlier.

Sectors Activity

Financial Services excluding Banks was the most active sector through last week, recording a volume of trades of 539 million securities worth EGP 1.152 billion.

Telecommunications came second, attaining a volume of trades of 441 million securities worth EGP 799 million.

Real Estate reported third, with a volume of trades of 249 million securities worth EGP 1.14 billion.

Travel & Leisure sector was on the fourth position, getting a volume of trades of 143 million securities worth EGP 327 million.

Personal and Household Products came fifth, recording a volume of trades of 106 million securities worth EGP 278 million.

Industrial Goods and Services and Automobiles reported sixth, having a volume of trades of 92.5 million securities worth EGP 151 million.

Construction and Materials was on the seventh position, with a volume of trades of 57 million securities worth EGP 174 million.

Healthcare and Pharmaceuticals was on the ninth position, with a volume of trades of 16 million securities worth EGP 27 million.

Banks reported tenth, recording a volume of trades of 9.4 million securities worth EGP 235 million.

Basic Resources came eleventh, attaining a volume of trades of 9.1 million securities worth EGP 136 million.

At the bottom of the list, Chemicals reported twelfth getting a volume of trades of 4.3 million securities worth EGP 55 million.

Investors’ Activity

Local investors led the market activity all through the week with 85.32%, followed by Foreign and Arab investors with 5.85% and 8.83%, respectively.

Foreign investors were the most active sellers during the week earning the value of EGP 36.35 million , after excluding the deals.

Arab investors were also to sell by value of EGP 73.12 million, after excluding the deals.

Moreover, institutions seized 32.60% of total trading through the week; while individuals attained 67.40% . Institutions were the most active buyers during the week earning the value of EGP 76.40 million, after excluding the deals.

Through the week, the trading volume hit 1.5 billion securities, compared to 1.3 billion securities at the end of a week earlier. For the traded value, it reached EGP 4.481 billion against EGP 4.2 billion a week earlier.