During Thursday closing session, the Egyptian Exchange (EGX) has extended its early losses to eventually reach EGP 1.7 billion as the capital market has amounted to EGP 373.199 million.

The EGX indices end the week in red.

The main index, EGX30 pushed down by 0.78% to close at 5439.29 p. EGX20 fell by 0.59% to end at 6223.9 p.

Meanwhile, the mid- and small-cap index, the EGX70 edged down by 0.15% to conclude at 480.91 pts. Price index EGX100 dropped by 0.47% to finish at 806.8 p.

Egypt Rebels Coalition called on the Egyptian people to take part in Friday demonstration in Tahrir Square. The protest is calling for deposing the government, purging the security authorities, sacking the Prosecutor General; for slacking off his role in providing the evidences against protesters’ killers.

Traded volume reached 75.169 million securities worth EGP 261.745 million, exchanged 17.619 thousand transactions.

This was after trading in 170 listed securities; 73 declined, 57 advanced; while 40 keeping their previous levels.

EGX’s losses were driven by the local investors’ selling pressures.

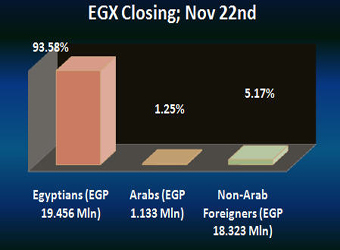

Egyptians were net sellers seizing 93.58% of the total markets, with a net equity of EGP 19.456 million excluding the deals.

On the other hand, the non-Arab Foreigners and Arabs were net buyers seizing 5.17% and 1.25% respectively, of the total markets, with a net equity of EGP 18.323 million and EGP 1.133 million excluding the deals.

EGX’s main shares witnessed unsteady performance.

Orascom Telecom Media & Technology Holding (OTMT.CA)’s stock remained with no change at EGP 0.57.

EFG-Hermes Holding (HRHO.CA) dipped by 0.74% to end at EGP 10.71.

Orascom Construction Industries – OCI (OCIC.CA)’s stock also went down by 0.67% to end at EGP 252.24.

Citadel Capital, the leading private equity firm in the Middle East and Africa, surged by 1.63% to conclude at EGP 3.73. This was after Citadel Capital SAE with US$ 9.5 billion in investments under control, on Thursday signed a project development and shareholders’ agreement pursuant to which a group of Qatari investors, arranged by QInvest, and Citadel Capital will form a joint venture to construct and own the facilities required to position a Floating LNG storage and regasification unit (FSRU) at a location in Egypt to deliver natural gas to high-volume end-users.

“We are delighted to partner with QInvest on this project, which will stand as an important pillar of Egypt’s energy security at a key moment in the nation’s development,” said Citadel Capital Chairman and Founder Ahmed Heikal. “We believe that Egypt is in strong need of additional natural gas to feed the power generation sector and supply Egypt’s industrial base with a reliable, clean source of energy. Citadel Capital has very strong technical skills in this sector and unrivalled knowledge of the current and planned large consumers of natural gas, thereby putting us in a unique position to market imported natural gas in Egypt.”

Orascom Telecom Holding (ORTE.CA)’s stock went up by 0.28% to close at EGP 3.62.